$1 Spent in Your Business Isn’t $1 Saved on Taxes

Just because something is a business expense, doesn’t mean it’s free money. The goal in every business should be to keep your money, not spend it. Spending money to save it on […]

Just because something is a business expense, doesn’t mean it’s free money. The goal in every business should be to keep your money, not spend it. Spending money to save it on […]

As a pet owner, you may be surprised to learn that some of your expenses related to your furry friend may be tax deductible. While the IRS does not allow pet expenses […]

Wondering how you should pay yourself? Well, with IRS requirements, sometimes it can be confusing on how to actually give yourself your hard earned money. We have everything you need to know […]

Everyone loves free stuff, but no one loves an unexpected tax bill. If you’re an influencer and you get gifts from companies, we have all you need to know on the differences […]

After the recent storms in California, the Federal Emergency Management Agency declared that individuals and businesses that were affected by the storms now qualify for an extension on various tax returns. The […]

One of the biggest questions people have when it comes to doing their taxes is, “who can I write off as a dependent and how do I do it?” WHO QUALIFIES AS […]

With tax season in session, you may be wondering whether or not to hire someone to do your taxes or whether to do them on your own. While it may seem hectic […]

Did you know you can write off some of your investments, giving you a double benefit financially? The IRS allows tax deductions for investment-related expenses if those expenses are related to producing […]

Medical expenses can seem like a burden to some people, and it is often confusing on whether or not you can deduct them from your taxes. In order to be able to […]

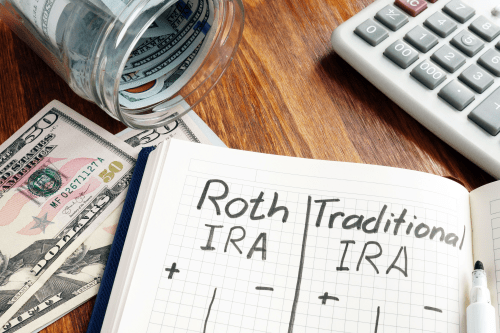

The average American has less than $110,000 saved before they retire. This gives most retired Americans less than three years to live off of. If you want to boost your retirement account […]

If you’re a first time home buyer and hoping to get some major tax breaks to help you pay your mortgage, we have everything that you need to know. Unfortunately, the tax […]

Both individuals and tax professionals have been confused recently regarding federal tax status on special payments in 16 states. On Friday, the Internal Revenue Service provided details regarding this confusion. Here’s everything […]